Blog Article

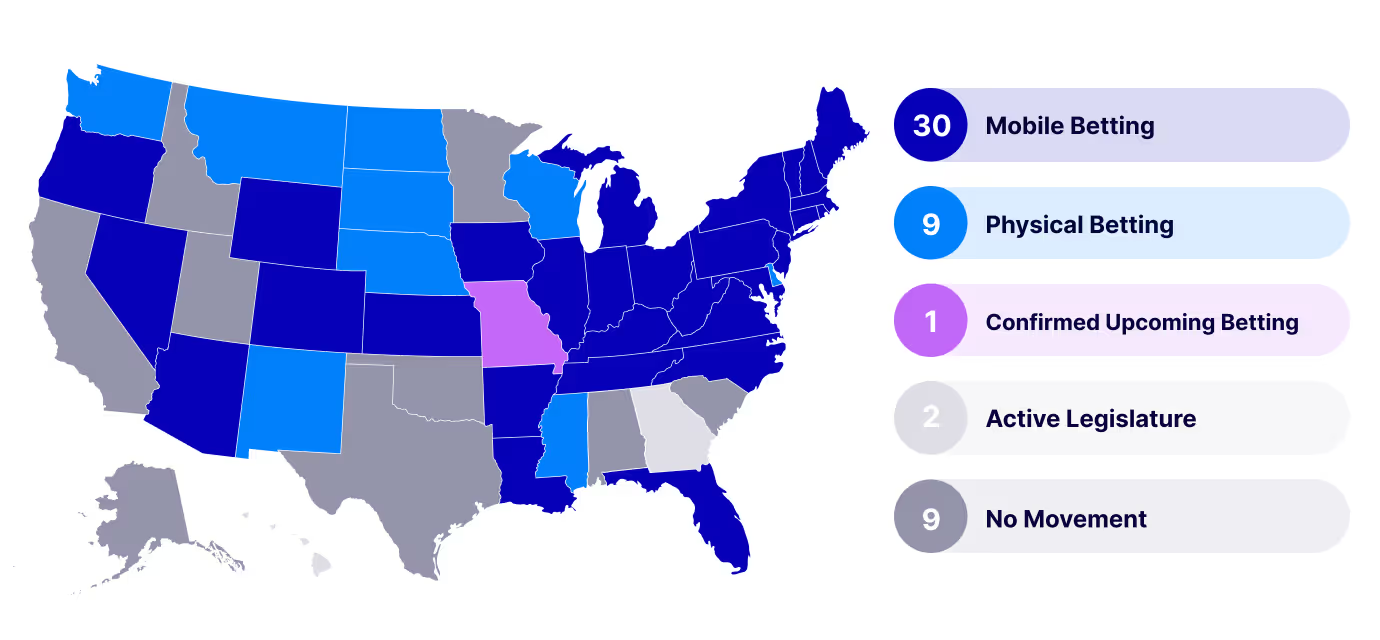

When Missouri launches sports betting in December 2025, almost 4 million adults will be able to place their first legal bets. For advertisers, this is a rare opportunity in the maturing US market: establishing an early foothold in an untapped market.

In just the first month of December, we estimate that Missouri may generate as much as $390 million in betting activity, and total wagers in the first year could be as high as $4.5bn.

.avif)

Missouri's December launch benefits from peak NFL season timing and features nine licensed operators, including DraftKings, FanDuel, BetMGM, and Caesars. The state's 10% tax rate (the lowest among major Midwest markets) is likely to drive intense competition.

The clearest indicator of Missouri's potential comes from consumer intent data. Nearly one in four Missouri adults indicate that they are likely to place sports bets once legal. Of this audience, over 280,000 expect to bet regularly (multiple times per year).

.avif)

This intent is backed by early behavioral signals: roughly 20% of Missourians report already placing bets through neighboring states or other channels, with GeoComply blocking 24 million betting attempts from Missouri in 2023 alone. This has only intensified in recent years with the success of the Chiefs. In 2024, GeoComply estimated that close to half a million Missourians were blocked from placing bets for Super Bowl 58.

Capturing this demand will mean reaching the right users where they are, which makes mobile app marketing the critical channel for this moment. Moloco processes 2 billion advertising opportunities daily in Missouri, reaching over 4 million Missouri adults (21+) a month through the independent app ecosystem.

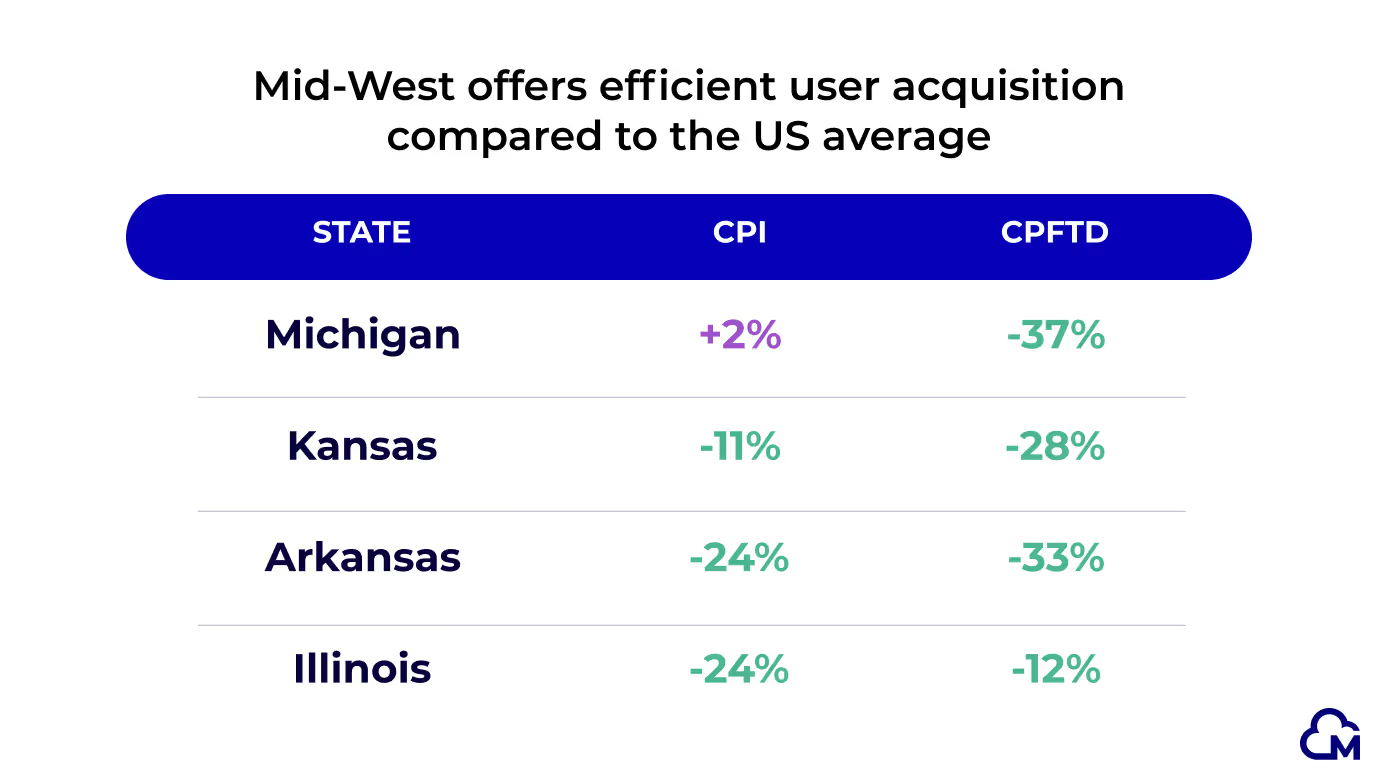

Despite pent-up demand, the current market conditions are favoring efficient customer acquisition. Outside of Super Bowl weekend, pre-season is traditionally the most competitive period for user acquisition, which means mid-season can see lower than average acquisition costs. Moloco benchmarks show that cost per first-time deposit (cpFTD) on iOS has declined by as much as 48% from August highs. Historic trends suggest that these low acquisition costs will hold through December (aligning with 4 Chiefs games). All to say: the timing couldn’t be better for Missouri to come online.

.avif)

Moloco benchmarks highlight that Missouri's neighboring states (Illinois, Kansas, and Iowa) consistently show below-average CPIs, suggesting similar efficiency for Missouri campaigns.

In so many ways, Missouri punches above its weight. Although it’s only 1.9% of the U.S. population, we believe it’s positioned to capture 5%+ of national sports betting marketing spend in the first year:

The launch in this ripe new market will mean big competition, but advertisers who prioritize mobile acquisition can make the most of low acquisition costs and early mover advantages.

.jpg) The Race for the Interface: Why Customer Relationships Are Your Best Defense Against AI Disruption

The Race for the Interface: Why Customer Relationships Are Your Best Defense Against AI DisruptionAI is disrupting traditional discovery channels like search, making direct customer relationships through owned surfaces like mobile apps the most critical competitive advantage for brands to maintain visibility and control in an AI-mediated future.

.png) Super Bowl LX: Why Sportsbook Advertisers Should Bet on January

Super Bowl LX: Why Sportsbook Advertisers Should Bet on JanuaryThe Super Bowl is the world's biggest sporting stage, but waiting until February to activate could be costing you.

The AppsFlyer Performance Index (2025 Edition) recognizes Moloco as a top mobile growth partner

The AppsFlyer Performance Index (2025 Edition) recognizes Moloco as a top mobile growth partnerCheck out Moloco’s top rankings in the 2025 edition of AppsFlyer’s Performance Index, a trusted benchmark for mobile app marketers seeking leading media partners.

.jpg) Unwrapping Seasonal Strategies: Where the Growth Lives Across Q4 and Q5

Unwrapping Seasonal Strategies: Where the Growth Lives Across Q4 and Q5Winning the holidays means seeing where user behavior and marketing activity converge—and diverge.